In summary, the AP turnover ratio is a key indicator within a broader financial analysis framework. A higher turnover ratio might suggest good liquidity, implying the company is efficiently managing its payables. Some businesses may negotiate longer payment terms to improve their cash flow, leading to a lower turnover ratio without indicating inefficiency or financial distress. This aspect underscores the importance of understanding the context of supplier agreements when analyzing the ratio.

Company

It can have an impact on cost of goods sold, as suppliers may use that ratio to determine financing terms—and that can affect the bottom line. Furthermore, a high ratio can sometimes be interpreted as a poor financial management strategy. For instance, let’s say a company uses all its cash flow to pay bills instead of diverting a portion of funds toward growth or other opportunities. A high Accounts Payable Turnover Ratio is an indication of a company’s financial health and creditworthiness. Lenders, investors, and creditors use the ratio as a key indicator when evaluating a company’s creditworthiness.

Payables Turnover Ratio vs. Days Payable Outstanding (DPO)

Yes, a higher AP turnover ratio is better than a lower one because it shows that a business is bringing in enough revenue to be able to pay off its short-term obligations. This is an indicator of a healthy business and it gives a business leverage to negotiate with suppliers and creditors for better rates. A consistently higher ratio typically indicates timely payments, but extremely high ratios might also warrant scrutiny. A high AP turnover ratio demonstrates prompt payment to suppliers, which can strengthen relationships and potentially lead to more favorable pricing terms. A low ratio, however, may signal ineffective vendor relationship management and could harm partnerships. If your business relies on maintaining a line of credit, lenders will provide more favorable terms with a higher ratio.

Delivering business outcomes

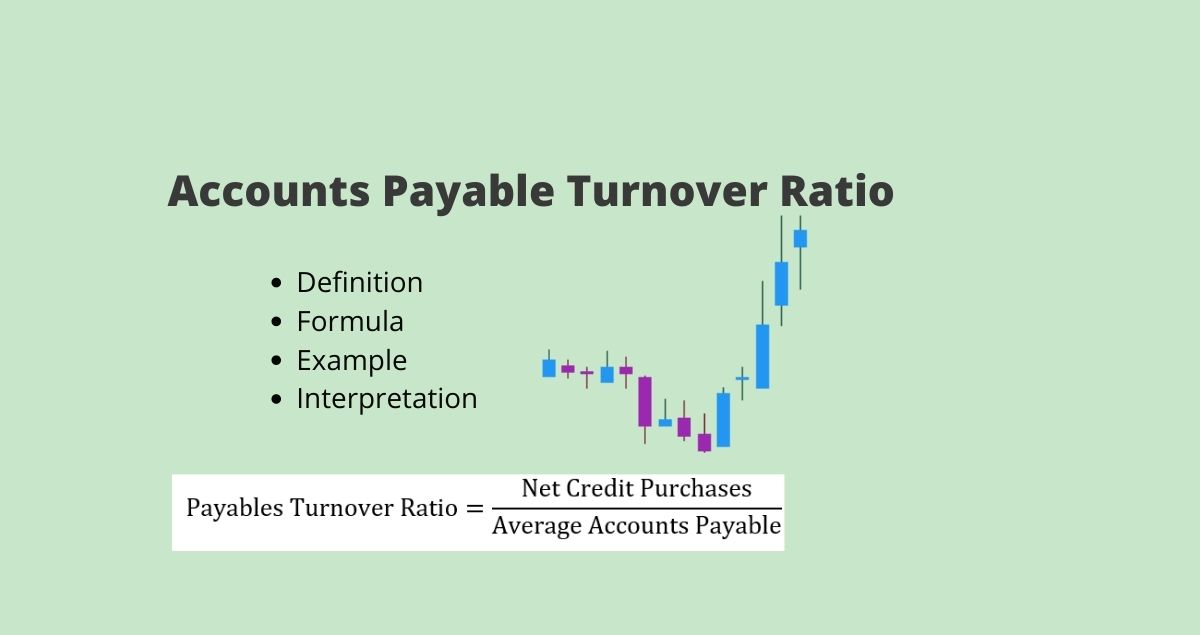

- It is a financial ratio that helps in the analysis and evaluation of creditor payment policies and procedures.

- Therefore, it is essential to analyze multiple financial ratios and metrics to make informed decisions about a company’s financial health.

- This ratio helps creditors analyze the liquidity of a company by gauging how easily a company can pay off its current suppliers and vendors.

Start by adding the accounts payable balance at the end of the chosen period with the accounts payable balance at the beginning of the period. Look for opportunities to negotiate with vendors for better payment terms and discounts. When you take early payment discounts, your inventory costs less, and your cost of goods sold decreases, improving profitability. Your cash flow improves because less cash is required to pay the vendor invoices.

The ending balance might be representative of the total year, so an average is used. To find the average accounts payable, simply add the beginning and ending accounts payable together and divide by two. The rules for interpreting the accounts payable turnover ratio are less straightforward.

Industry Benchmarking for AP Turnover Ratio

Creditors and investors will look at the accounts payable turnover ratio on a company’s balance sheet to determine whether the business is in good standing with its creditors and suppliers. Higher figures indicate that a company pays its bills on a more timely basis, and thereby has less debt on the books. A high accounts payable ratio signals that a company is paying its creditors and suppliers quickly, while a low ratio suggests the business is slower in paying its bills. This is a critical metric to track because if a company’s accounts payable turnover ratio declines from one accounting period to another, it could signal trouble and result in lower lines of credit.

In short, in the past year, it took your company an average of 250 days to pay its suppliers. The A/P turnover ratio and the DPO are often a proxy for determining the bargaining power of a specific company (i.e. their relationship with their suppliers). For example, if a company’s A/P turnover is 2.0x, then this means it pays make this au payroll year end the smoothest yet off all of its outstanding invoices every six months on average, i.e. twice per year. Balance your cash inflows and outflows to get a better understanding of how to improve the AP turnover ratio. It can help you with finding a way to keep sufficient cash on hand that may be required to support the goals of the business.

Suppose the company in question has not renegotiated payment terms with its suppliers. In that case, a decreasing ratio could show cash flow problems or financial distress. So, while the accounts receivable turnover ratio shows how quickly a company gets paid by its customers, the accounts payable turnover ratio shows how quickly the company pays its suppliers. The accounts payable turnover ratio shows investors how many times per period a company pays its accounts payable. In other words, the ratio measures the speed at which a company pays its suppliers. Accounts payable analytics is useful for evaluating the efficiency of your company’s accounts payable process.